Global Secondary Battery Market: By Product Type (Lead-acid Batteries, Lithium-ion Batteries, and Other Batteries), By Application (Automotive Batteries, Industrial Batteries, and Portable Batteries), By End User (Aerospace, Automobile, Electronics, Energy Storage, Military and Defenses,and Others), and By Region(North America, Europe, Asia-Pacific, Central and South America, and the Middle East and Africa)- Forecast Period till 2032

- Description

- Additional information

Description

Market Overview

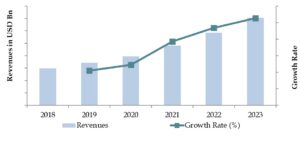

The Global Secondary Battery Market was valued at USD 120.5 billion in 2023 and is projected to reach USD 385.04 billion by the year 2032, with a CAGR of 13.80% during the forecast period from 2024 to 2032.A secondary battery is a rechargeable electrical battery that can undergo repeated charging, discharging, and recharging, unlike primary or disposable batteries that are used once and discarded. Lithium-ion batteries are the predominant type in the secondary battery market, favored for their high capacity-to-weight ratio. The proliferation of smartphones, a rapidly growing segment in consumer electronics, significantly influences the secondary battery market.

The demand for secondary batteries has surged with the emergence of new sectors like electric vehicles and energy storage systems (ESS). Integrating ESS with renewable energy sources such as wind, solar, or hydroelectric power offers feasible solutions for enhancing grid stability. Technological advancements, growth in end-user industries, and governmental support for energy storage infrastructure are key drivers fueling the global expansion of the secondary battery market.

Market Size for Global Secondary Battery Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Marven Market Research

Affecting Growth of the Global Secondary Battery Market

- Rise in Electric Vehicle Adoption– Initially dominated by the consumer electronics sector, the secondary battery market has seen a significant shift towards electric vehicles (EVs) becoming the largest consumers of lithium-ion batteries. EVs offer environmental advantages over traditional internal combustion engine (ICE) vehicles by eliminating CO2, NOX, and other greenhouse gas emissions. This environmental benefit has prompted governments worldwide to incentivize EV adoption through subsidies and supportive policies. The declining cost of lithium-ion batteries has further lowered the manufacturing costs of EVs. Additionally, Nickel Metal Hydride (NiMH) batteries are gaining traction in the automotive sector for their wide temperature range and rapid charging capabilities.

- Reduction in Lithium-Ion Battery Costs– Over the past decade, the cost of lithium-ion batteries has steadily decreased. Continued research and development efforts have focused on improving battery performance through advancements in materials, reduction of non-active materials, optimized cell design, enhanced production efficiency, and accelerated manufacturing processes. Innovations in battery separators have also played a critical role in cost reduction. While consumers benefit from lower prices, intensified competition among manufacturers has squeezed profit margins.

Restraints in the Global Secondary Battery Market

- Disparity in the Demand&Supply for Raw Materials– As the cost of lithium-ion batteries continues to decrease, there has been a significant increase in demand for the minerals and components crucial for battery production. This surge in demand has led to higher mineral prices and exacerbated shortages in supply, particularly affecting manufacturers in the Asia-Pacific region striving to maintain full capacity at their lithium-ion battery plants.With growing investments in electric vehicle (EV) manufacturing, the consumer electronics sector faces stiff competition for lithium-ion batteries. Moreover, the battery manufacturing process generates wastewater and releases various pollutants, necessitating stringent environmental management practices. These challenges are likely to hinder market growth in the foreseeable future.

What is the current structure of the Global Secondary Battery market?

Based on Product Type, the Lithium-ion segment dominates the Global Secondary BatteryMarket

The Lithium-ion category led the market, capturing 40.77% of the global revenue share in 2022, primarily driven by the burgeoning e-mobility sector. The electric vehicle (EV) industry is poised to sustain the dominance of lithium-ion battery solutions in the years ahead.Lead-acid batteries secured the second-largest market share globally in terms of revenue in 2023. Increasing demand for rechargeable batteries, specifically starting, lighting, and ignition (SLI) batteries in the automotive sector, is projected to bolster market growth during the forecast period.Lithium-titanate-oxide (LTO) emerged as the fastest-growing product in the global battery market due to its rapid charging capabilities surpassing other lithium-ion variants.

Based on Application, the Industrial Batteries dominates the market revenue CAGR in the Global Secondary Battery Market

In 2022, Industrial batteries accounted for the largest market share of 35.85% in the application segment owing to growing requirements for efficient power backup and energy storage systems in various industries such as power generation, chemical manufacturing, marine, recreation equipment, and agricultural machinery & equipment. The adoption of small-sized lithium-ion batteries in portable devices and other consumer electronics is expected to boost market growth during the forecast period. In 2023, automotive batteries represented the second-largest application segment, accounting for 34.62% of the global market share in terms of revenue. The increase in passenger car production in developing countries such as China, India, Brazil, and Russia is anticipated to further drive market growth throughout the forecast period.

Based on End-UseInsights, theAutomobile segment dominates the Global Secondary Battery Market

The automobile sector led the global battery market with a substantial market share of 32.37% in 2023. Increasing awareness of the benefits of battery-operated vehicles in regions such as Asia Pacific, Europe, and North America is expected to drive the adoption of lithium-ion batteries in automotive applications during the forecast period.Electronics represented the second-largest segment, driven by widespread use in portable consumer electronic devices including smartphones, laptops, tablets, digital cameras, LED lights, vacuum cleaners, and more.The expansion of medical facilities worldwide and the adoption of advanced healthcare technologies are projected to stimulate demand in the medical, construction, and firefighting segments of the lithium-ion battery market throughout the forecast period.

Based on Region, the Asia Pacific Region dominates the market revenue share in the Global Secondary Battery Market

Asia Pacific dominated the global market in 2023, commanding the largest revenue share of more than 55.67%. Significant growth is expected in commercial, residential, and grid storage sectors due to factors such as industrialization, urbanization, and increasing disposable incomes in developing countries. Supportive regulatory frameworks aimed at attracting investments are also contributing to market expansion in the region.Investments in sustainable innovations like electric bikes, cranes, and forklifts are likely to foster further expansion of the battery market.

Competitive Analysis

The industry is expanding rapidly as a result of the growing demand for lithium-ion batteries brought on by the quick uptake of energy storage systems (ESS) and EVs (Electric Vehicles). The Internet of Things (IoT) and Artificial Intelligence (AI) developments are driving growth in the telecommunications industry. Minerals including cadmium, cobalt, copper, cyanide, iron, lead, manganese, mercury, nickel, and zinc are in greater demand as attention turns to renewable energy production from wind, solar, and hydro sources. In order to fulfill demand, businesses like InoBat are developing while addressing issues like the cost of lithium-ion batteries and the availability of sustainable materials.Some of the major player operating in the market includes Amperex Technology Limited (TDK Corporation), Byd Company Limited, Duracell Inc. (Berkshire Hathaway Inc.), Energizer Holdings Inc., EnerSys, LG Chem Ltd., Panasonic Corporation, Saft (TotalEnergies SE), Samsung SDI Co. Ltd., Showa Denko K. K., Sony Group Corporation and Tianjin Lishen Battery Joint-Stock Co. Ltd.

Market Segmentation

By Product Type

- Lead-acid batteries

- Lithium-ion batteries

- Others

By Application

- Automotive Batteries

- Industrial Batteries

- Portable Batteries

By End Users

- Aerospace

- Automobile

- Electronics

- Energy storage

- Military and defenses

- Others

By Region

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- North America

- United States

- Mexico

- Canada

- Europe

- United Kingdom

- France

- Germany

- Italy

- Central and South America

- Brazil

- Paraguay

- Columbia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Leading Companies in the Global Secondary Battery Market

- GS Yuasa International Ltd.

- Hitachi Ltd.

- Johnson Controls

- Panasonic Corporation

- Samsung SDI Co.Ltd.

- NEC Corporation

- Toshiba Corporation

- LG Chem

- BYD Company Ltd.

- A123 Systems LLC

- Narada Power Source Co. Ltd.

- Contemporary Amperex Technology Corporation Limited

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com