Global Insurance Market: By End-Use (Corporations, Individuals) By Channel (Brokers and Agents, Distributors) and Geography, and by Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa)—Forecast till 2028

- Description

- Additional information

Description

Market Overview:

The global insurance market platform market size was valued at USD 42.3 trillion in 2023 and is projected to expand at a CAGR of 4.7% from 2024 to 2028. The surging technological advancements, increasing urbanization, elevating aging population, and constant changes together with the rising awareness have led to accelerating the growth of the market in the forthcoming years.

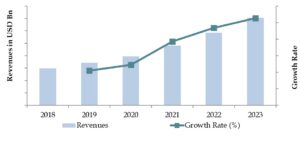

Market Size for Global Insurance Market on the Basis of Revenues in USD Bn , 2018-2023

Source: Maven Market Research

What Factors are Leading to the Growth of the Global Insurance Market

- The evolution of regulatory frameworks across different regions of the world is propelling the growth of the market. The introduction of new policies by governments and regulatory bodies has enhanced transparency and protect consumer interests. This has majorly influenced the growth of the market.

- With the increasing financially literate population, the demand for various types of insurance products, including health, life, and property insurance, is on the rise. Moreover, the accelerating frequency of natural disasters and global pandemics have raised the necessity for a comprehensive insurance market.

- Furthermore, the integration of technological advancements is enhancing customer experience, streamlining operations, and developing more accurate risk assessments by the insurers. These aspects have augmented the growth of the market in the review period.

Which Industry Trends have been Fueling the Growth of the Insurance Market?

Performance By Key Players: Major key companies are continually developing new and innovative insurance products so that insurers that can quickly adapt to market trends and offer unique products have a competitive advantage. For instance, Allianz SE, a German multinational financial services company, is one of the leading insurance companies globally. The company focuses on a wide range of insurance products, including life, health, property, and casualty insurance. Hence, propelling the overall growth of the market.

Increasing Urbanization: The regular expansion of economic growth and rise in urban centers have raised the demand for insurance products such as auto, home, and commercial insurance. Moreover, urbanization often leads to higher property values and more complex commercial activities, hence driving the market share of the sector.

Rising Aging Population: With the increasing life expectancy, the need for retirement planning and long-term care insurance also increases. It is observed that insurers are developing specialized products to cater to the needs of the elderly, including health plans that cover chronic illnesses. This has led to a major contribution to the market

What is the Current Structure of the Global Insurance Market?

By End-User Type, Commercial Sector has Dominated the Largest Market Share in the Global Market

The commercial sector includes businesses from small-scale enterprises to large-scale enterprises. These enterprises require insurance to safeguard against operational risks, property damage, liability claims, and employee-related risks. Moreover, commercial property insurance and liability insurance insurance are critical for businesses to mitigate potential financial losses and ensure business continuity.

By Channel Type, Brokers and Agency Segment Dominated the Largest Market Revenue in the Global Market

The brokers play a crucial role in the insurance market by providing personalized advice and helping customers choose the right insurance products. Moreover, the rise of digital platforms has significantly boosted direct sales, allowing insurers to reach customers more efficiently and reduce costs associated with intermediaries, hence driving the overall growth of the market.

By Region Type, North America Leads the Market

North America, especially the United States and Canada, is characterized by a high penetration rate of various insurance products, driven by stringent regulatory requirements and high consumer awareness. Additionally, the Asia-Pacific regions are observing high economic expansion, urbanization, and increasing awareness of insurance benefits. These elements are predicted to augment the growth of the market.

Competitive Analysis

The global insurance market is experiencing significant growth due to the integration of technological advancements, regulatory changes, and economic growth. Additionally, the key players in the industry are leveraging innovation and customer-centric approaches to maintain competitive edges. Also, companies with strong balance sheets and high credit ratings are often preferred by customers. Hence, the market is expected to witness growth in several regions of the world in the upcoming years.

Market Segmentation

Global Insurance Market, By End User Type

- Individuals

- Corporations

- Small and Medium Enterprises (SMEs)

- Government and Public Sector

- Non-profit Organizations

Global Insurance Market, By Channel Type

- Direct Sales

- Brokers and Agents

- Bancassurance

- Online and Digital Platforms

- Tied Agents

Global Insurance Market, By Application Type

- Life Insurance

- Health Insurance

- Property and Casualty Insurance

- Travel Insurance

Global Insurance Market, By Region Type

North America

- United States

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Key Players

- Allianz

- AXA

- Ping An Insurance

- China Life Insurance

- Berkshire Hathaway

- Prudential Financial

- UnitedHealth Group

- Munich Re Group

- Zurich Insurance Group

- MetLife

- AIA Group

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com