Global Cooking Oil Market: By Type (Palm Oil, Rapeseed Oil, Sunflower Oil, Peanut Oil, and Other Types), Application (Bakery and Confectionery, Snack Foods, Salads, Cooking Oils, and Other Applications), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa)-Forecast till 2030

- Description

- Additional information

Description

Market Overview:

The global cooking oil market was valued at USD 204.55 billion in 2023. It is estimated to expand from USD 218.36 billion in 2024 to USD 369.20 billion by 2032, showing a compound annual growth rate (CAGR) of 6.79% during the forecast period (2024-2032).An increasing number of individuals eating at home has propelled the consumption of cooking oil during recent years, and this trend is expected to impact market growth during the future significantly. Additionally, shifting customer preferences and a high requirement for processed foods will further foster cooking oil demand throughout the forecast period.

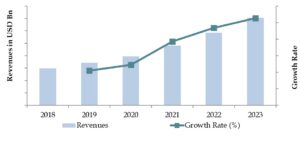

Market Size for Global Cooking Oil Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Maven Market Research

What Factors are Leading to the Growth of the Global Cooking Oil Market:

- The market is fostered by a strong requirement for organic and healthier unsaturated goods. The foremost factors underwriting market growth include the growing usage of avocado oil for its nutritional advantages, the increasing requirement for affordable and versatile canola oil in snacks, and the rise in healthy soybean oil product launches by key companies.

- The growing usage of vegetable oil for biodiesel production and an increasing emphasis on sustainability are foremost factors estimated to introduce significant growth opportunities for cooking oil companies in the future.

- Advancements in oil manufacturing procedures and the growing requirement for sustainable extraction methods are also anticipated to surge cooking oil sales over the next decade.

Which Industry Trends have been Fueling the Growth?

Rising Health Awareness Among Young Population: The surging awareness of healthy lifestyles and the harmful impacts of a high-saturated-fat diet is a key driver in the cooking oil market. Health-conscious customers are increasingly selecting oils low in saturated fats and rich in essential nutrients. Oils high in omega-3 fatty acids, including flaxseed oil, and those with heart-healthy monounsaturated fats, like olive oil, are seeing increased requirements. Due to this trend, manufacturers are introducing oils that meet precise dietary requirements, encouraging heart health and overall well-being.

Growing Requirement for Processed Foods in Emerging Countries to Increase Requirement for Cooking Oil: The growing global consumption of processed foods is projected to significantly surge market growth. Customer preference for packaged and processed food will rise the requirement for cooking oils by small food chains, households, and restaurants, propelling market expansion. In addition, the income growth rate, coupled with urbanization and the expansion of the middle class, leads to more different diets, thereby growing the requirement for processed food products. According to a report by the Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization (FAO), in the least developed regions, the accessibility of vegetable oil is estimated to rise by 1.3% per year, touching 9 kg per capita during 2030 compared to 7.96 kg per capita during 2020. In addition, the U.S. Department of Agriculture (USDA) reports that cooking/edible oil imports into underdeveloped countries are projected to rise by 34%, registering for 79% of global import growth owing to factors including tourism and population growth. Thereby, these factors are projected to propel market growth in the coming years.

What is the Current Structure for Global Cooking Oil Market?

By End User, Residential Segment Dominates the Market Growth Globally

The residential sector is estimated to hold the largest market share, expanding at a CAGR of 6%. The acceptance of healthy oils and foods is growing as consumers become more informed about the different types of oils and their advantages and drawbacks. Rising health consciousness and growing disposable incomes are propelling consumers to prefer well-known market brands, driving the expansion of the cooking oil market in the residential sector. Additionally, the requirement for organic cooking oil in the home market is growing due to rising consumer awareness of organic products.

By Distribution Channel, Business-to-Business Registers the Largest Market Growth

The business-to-business (B2B) sector is anticipated to hold the largest market share, mounting at a CAGR of 5.3%. The growing prevalence of outdoor dining is the primary driver fostering B2B sales of cooking oil. As consumers’ living standards and disposable incomes enhance, more food is being consumed in restaurants, coffee shops, and other food service industries, growing the requirement for cooking oil. Additionally, cooking oil is extensively utilized in preparing ready-to-eat snacks and other prevalent food items, further propelling requirements in the B2B sector.

By Region, Asia Pacific Holds the Largest CAGR in the Global Market

Asia Pacific held a dominant position in the global market, touching USD 117.11 billion during 2023. The region’s significant growth is propelled by factors including urbanization, dietary shifts, surged consumption of processed foods, and enhanced living standards. There is an increasing consumer preference for foods that not only taste good but also propose health and nutritional advantages, which is expected to foster market expansion. In countries including China, India, and Indonesia, growing urbanization has led to a shift towards processed foods among customers.

The region’s rapidly expanding distribution networks are projected to play an essential role in fostering sales. For instance, Adani Wilmar, a joint venture between Adani Group and Wilmar International, announced the launch of the Fortune online mobile application during May 2021. This initiative was focused at catering to the growing preference for online grocery shopping, specificallyincreased by the COVID-19 pandemic. The development of e-commerce platforms for online retailing is projected to further surge sales growth during the coming years.

Competitive Analysis

Companies are progressively prioritizing the launch of new products to increase sales potential and obtain a competitive edge in the cooking oil market. In addition, the expanding usage of cooking oils in sustainable fuel and biodiesel production industries is projected to propel market growth and present lucrative business opportunities for leading cooking oil producers in the forecast period. Some of the major player includes Archer Daniels Midland Company, Bunge Limited, Fuji Oil Group, Cargill Incorporated, and Olam Oil Group

Market Segmentation

Global Cooking Oil Market, By End Users

- Commercial

- Residential

- Food Processors

Global Cooking Oil Market, Distribution Channel

- Supermarkets/Hypermarkets

- Independent Retail Stores

- Business-to-Business

- Online sales channels

Global Textile Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- Russia

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Rest of Asia-Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Turkey

- South Africa

- Rest of Middle East & Africa

Market Players Included

- Archer Daniels Midland Company

- Cargill Incorporated

- Bunge Limited

- Olam Group Limited

- Fuji Oil Group

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com