Global Cold Chain Transportation Market: By Type (Refrigerated warehouses, Refrigerated transportation), By Application (Fruits & vegetables, Fish, meat & Seafood,Dairy & frozen dessert,Bakery & confectionery, Pharmaceutical,Processed foods, others) By Region (North America, Europe, Asia-Pacific, Rest of the world)- Forecast till 2030

- Description

- Additional information

Description

Description

Market Overview

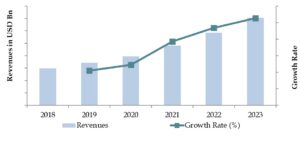

The Global Cold Chain Transportation Market is poised to achieve USD 641 billion by 2030, with a robust CAGR of 11.87% during the forecast period from 2022 to 2030. This growth is primarily driven by escalating demand for temperature-regulated storage and transport across diverse sectors such as food, chemicals, and pharmaceuticals. The surge in global trade has intensified the movement of goods across borders, fueling the need for cold chain logistics. This ensures that perishable items maintain optimal temperatures throughout their journey and storage, regardless of duration or distance. The COVID-19 pandemic has underscored the critical role of the cold chain, particularly in the distribution of vaccines and medical supplies, further driving market expansion. Significant investments in technology and infrastructure are anticipated to enhance cold chain logistics, ensuring secure and efficient distribution of temperature-sensitive goods.

Market Size for Global Cold Chain Transportation Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Maven Market Research

Factors leading to the Growth of the Global Cold Chain Transportation Market:

Increasing Demand for Fresh Perishable Goods- The rise in the global population and evolving consumer preferences have amplified the demand for perishable items such as fresh produce, dairy products, and frozen foods. Customers now look fordiversified, high-quality products and driving expansion in the cold chain logistics market. This necessitates a robust cold chain infrastructure to ensure the secure transportation and storage of perishable goods, thereby stimulating market growth.

Advancements in Pharmaceutical Technology- Innovations in the pharmaceutical industry, including biologics and vaccines, have escalated the need for temperature-controlled transportation and storage. These sensitive products require precise temperature management to maintain their efficacy and integrity. The pharmaceutical sector’s reliance on cold chain logistics presents a significant driver, mandating specialized solutions to ensure the safe and efficient delivery of temperature-sensitive medicines, contributing to market expansion.

Restraining Factors:

Temperature Management and Control- Effectively managing temperature fluctuations during transportation and storage poses a critical challenge for the cold chain logistics industry. External factors like weather conditions, especially in long-distance or international shipments, can impact the integrity of the cold chain. Deviations from required temperature ranges can compromise product quality and safety, particularly in the pharmaceutical and food sectors.

Stringent Regulatory Requirements– The cold chain logistics industry faces stringent regulatory standards, particularly in sectors such as pharmaceuticals and healthcare. Adherence to these regulations demands meticulous planning, monitoring, and documentation across the supply chain. Non-compliance can lead to legal repercussions, product recalls, and reputational damage for companies involved in cold chain logistics, making regulatory compliance a pivotal challenge.

What is the current Market structure of the Global Cold Chain Transportation Market?

Based on type, the refrigerated warehouse segment leads the Global Cold chain Transportation Market

In terms of type analysis, the refrigerated warehouse segment currently commands the largest share of the market and is expected to maintain its leadership position in the foreseeable future. This dominance is driven by the rising demand for automated warehouse solutions to efficiently manage inventories. There is a growing global preference for packaged food products, influenced by evolving consumer dietary habits and lifestyles. This shift is significantly boosting the demand for frozen food items, thereby driving the need for refrigerated warehouse facilities. Additionally, the refrigerated transportation segment is poised to exhibit the highest compound annual growth rate (CAGR) during the forecast period.

Based on application, the dairy & frozen desserts segment leads the Global Cold chain Transportation Market

Based on application, the market is segmented into fruits & vegetables, fish, meat, and seafood, dairy & frozen desserts, bakery & confectionery, processed food, pharmaceuticals, and others. The dairy & frozen desserts segment currently holds the largest market share and is expected to continue dominating through the forecast period. This is driven by increasing consumer demand for animal protein products such as cheese, milk, and meat.The cold chain infrastructure plays a crucial role in transporting frozen bakery products such as bread and cakes, as well as frozen meats including fish, poultry, beef, seafood, and pork. Changing consumer dietary preferences and rising disposable incomes are further boosting demand for products in the bakery and confectionery segments.

Based on region, the North American region leads the Global Cold chain TransportationMarket

Based on geography, the market is segmented into Europe, Asia Pacific, North America, and the Rest of the World. In 2023, the North American region emerged as the dominant market. The region benefits from a high penetration of connected devices and a substantial consumer base, which are expected to foster market expansion from 2021 to 2028.Conversely, Asia Pacific is projected to be the fastest-growing regional market from 2024 to 2032. This growth is driven by increasing government investments in cold chain logistics infrastructure. Countries like South Korea, China, Japan, and India exhibit robust demand for meat, dairy, and processed food products, stimulating the cold chain market in the region. Furthermore, rising foreign direct investments in the healthcare sector and government initiatives promoting pharmaceutical industries contribute significantly to market growth in Asia Pacific.

Competitive Analysis

The market is seeing a steady increase in research-related initiatives and investments by key players leading to improved technology, a better supply chain, and new product and service launches. The leading vendors are focusing on strategic alliances, partnerships, and geographical expansion to strengthen their market position. We expect the market to witness new entrants, portfolio consolidation, increased collaborations, and mergers and acquisitions (M&As), to drive healthy competition within the domain. The global cold chain transportation market is growing steadily due to ongoing technological advancements and improvements in cold chain infrastructure worldwide. Some of the major players includes Americold Logistics, Inc.; LINEAGE LOGISTICS HOLDING, LLC; United States Cold Storage; Burris Logistics; Wabash National Corporation; NewCold; Sonoco ThermoSafe (Sonoco Products Company); United Parcel Service of America, Inc.; A.P. Moller – Maersk; NICHIREI CORPORATION; Tippmann Group

Market Segmentation

By Type

- Refrigerated warehouses

- Refrigerated transportation

By Application

- Fruits & vegetables

- Fish, meat & Seafood

- Dairy & frozen dessert

- Bakery & confectionery

- Pharmaceutical

- Processed foods.

- Others

By Region

Asia-Pacific

- China

- India

- Japan

- Rest of Asia-Pacific

North America

- United States

- Mexico

- Canada

Europe

- Germany

- United Kingdom

- France

- Rest of Europe

Rest of the world

- Middle East

- Africa

- Latin America

Major Key Players of the Global Cold Chain Transportation Market

- Americold Logistics LLC

- Agro Merchant Group

- Burris Logistics, Inc.

- Henningsen Cold Storage Company

- Lineage Logistics, LLC

- Nordic Logistics

- Preferred Freezer

- Wabash National

- Cold Chain Technologies, Inc.

- Cryopak Industries Inc.

- Creopack

- Cold Box Express, Inc.

- Intelsius

- Nilkamal Limited

- Sofrigam

- Softbox Systems Ltd.

- Sonoco ThermoSafe

- Valor Industries

Additional information

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com