Global Cargo Shipping Market: By Cargo Type (Container Cargo, Bulk Cargo, General Cargo, Liquid Cargo), By Industry Type (Food, Manufacturing, Oil & Ores, Electrical & Electronics) and By Region (North America, Europe, Asia-Pacific, Rest of the world). Forecast period: 2024-2032

- Description

- Additional information

Description

Market Overview

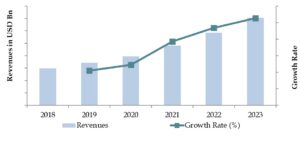

Global Cargo Shipping Market, valued at USD 14.6 billion in 2023, is projected to grow from USD 15.1 billion in 2024 to USD 23.4 billion by 2032, exhibiting a CAGR of 5.06% during the forecast period. Key growth drivers include free commerce agreements, additional port construction, and expanding trade in liquid, dry, general, and container cargo. Increased market demand, port infrastructure improvements, and continuous government support further enhance market growth.

A critical component of global trade, the cargo shipping market facilitates efficient transportation of goods via vessels and cargo ships, serving as a backbone for moving manufactured goods, raw materials, and essential food items worldwide. Growth is driven by economic liberalization in developing economies and advancements in shipping technology. During the COVID-19 pandemic, cargo shipping companies adapted to fluctuating demand, particularly for medical supplies and essential goods, while facing challenges such as port congestion and operational constraints due to social distancing measures.

Market Size for Global Cargo Shipping Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Maven Market Research

Factors leading to the Growth of the Global Cargo Shipping Market:

Digital Transformation Enhancing Capacity Optimization- Many shipping companies are increasingly collaborating with startups in the shipping sector specializing in data collection on cargo movements and vessel operations. This collaboration aims to optimize cargo routing and improve vessel deployment efficiency. For example, startups like Transmetric focus on analyzing cargo positioning data to accurately forecast cargo volumes, helping carriers avoid empty back-haul trips. Consequently, optimizing vessel deployment capacity is expected to drive revenue growth in the cargo shipping market.

Enhanced Efficiency and Reduced Environmental Impact– Cargo shipping is noted for its lower exhaust gas emissions per ton of cargo transported per kilometer compared to road, rail, or air transport. It is highly efficient and capable of transporting an average of 10,000 products and goods on a large containership during a single voyage. For instance, a few car carrier ships can handle nearly 7,600 cars on a single trip, which would otherwise require a fleet of trucks and several miles of railcars for the same volume.

Restraints for the Global Cargo Shipping Market:

Volatility in Fuel Prices- Cargo shipping is heavily dependent on fuel, and fluctuations in fuel prices can significantly impact operational costs and profitability for shipping companies. High fuel costs strain profit margins, particularly during periods of economic uncertainty or geopolitical instability, leading to financial challenges for operators.

Geopolitical Tensions and Trade Disputes Geopolitical instability, including trade disputes and sanctions between major economies, can disrupt global trade flows and affect demand for cargo shipping services. Uncertainty regarding trade policies and tariffs adds to the complexity of international logistics and supply chain management, influencing investment decisions and market dynamics.

What is the current structure ofthe Global Cargo Shipping Market?

Based on Cargo type, the Container cargo segment leads the Global cargo shipping Market

The market can be divided by cargo type into liquid bulk, dry bulk, general cargo, and container cargo. The container cargo segment is expected to show a higher CAGR during the forecast period due to the efficiency provided by standard-sized containers, which facilitate seamless intermodal transport by being easily loaded onto rail wagons, ships, and inland barges, thus enabling the transportation of large volumes in one trip. Additionally, the liquid bulk segment is likely to grow due to increased import demand for liquefied petroleum gas (LPG) in Europe and India, along with rising liquefied natural gas (LNG) demand driven by expanding U.S. supply and evolving energy policies in Asia.

Based on Industry type, the manufacturing segment leads the Global cargo shipping Market

The market, categorized by industry, includes food & beverages, manufacturing, oil, gas & ores, and electrical & electronics. The manufacturing segment is projected to lead the market in 2023, driven by economic growth, especially in developing regions of the Asia Pacific and the Middle East. The oil, gas & ores segment is also anticipated to experience significant growth due to increased exports from the U.S. and growing demand in China and India, fueled by high production levels of conventional fuel vehicles.

Based on region, the Asia-Pacific (APAC) region leads the Global cargo shipping Market

The Asia-Pacific region dominates the cargo shipping market, having accounted for USD 6.12 billion in 2022, and is expected to show significant CAGR growth during the study period. Known as a hub for automobile production, China held the largest market share for cargo transportation in this region. However, the increasing tariffs between China and the U.S. are projected to impact cargo shipping, leading to supply chain reorganization, trade flow diversion, and higher costs for consumers and manufacturers. The growth of the Asia-Pacific cargo shipping industry is driven by the rising use of outsourced logistics services and increased disposable incomes, which boost demand for imported raw materials and finished goods. This growth supports seaborne commerce in developing nations, further fueling the expansion of the cargo shipping market. Additionally, the market report covers key countries including the U.S., Canada, Germany, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Competition Landscape

Large market companies are heavily funding R&D to diversify their product offerings, which will encourage more market expansion for the cargo shipping sector. Along with the considerable changes in the industry—such as new product releases, contracts, mergers and acquisitions, higher investments, and partnerships with other organizations—market participants are also engaging in a range of strategic initiatives to enhance their market share. Major players in the cargo shipping industry, including DB Schenker (Germany), CMA CGM Group (France), MSC Mediterranean Shipping Company S.A. (Switzerland), P Moller – Maersk (Denmark), Panalpina World Transport (Holding) Ltd. (Switzerland), and others, are attempting to increase market demand by funding research and development initiatives.

Market Segmentation

By Cargo Type

- Container Cargo

- Bulk Cargo

- General Cargo

- Liquid Cargo

By Industry Type

- Food

- Manufacturing

- Oil & Ores

- Electrical & Electronics

By Region

Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia-Pacific

North America

- United States

- Canada

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Rest of the world

- Middle East

- Africa

- Latin America

Major Key Players Global Cargo Shipping Market

- P. Moller-Maersk

- Mediterranean Shipping Company (MSC)

- CMA CGM Group

- Orient Overseas Container Line (OOCL)

- China COSCO Shipping

- Evergreen International Corp.

- Hapag-Lloyd AG

- Ocean Network Express (ONE)

- Yang Ming Group

- HMM Co., Ltd.

- Panalpina World Transport

- Deutsche Bahn AG

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com