Global Swine Vaccines Market: By Product (Attenuated Live Vaccines, Inactivated Vaccines, Subunit Vaccines, DNA Vaccines, Recombinant Vaccines) By Type (Porcine Circovirus Type 2, Swine Influenza, Classical Swine Fever, Porcine Parvovirus, M. Hyo, Actinobacillus Pleuropneumonia, PRRS, Foot & Mouth Disease, Pseudorabies, Others) By Distribution Channel (Veterinary Hospitals& Clinics, Veterinary Research Institutes, Laboratories, Others) By Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Forecast Period till the year of 2033

- Description

- Additional information

Description

Market Overview

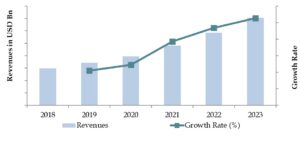

The Global Swine Vaccines Market is expected to grow from USD 1.6 billion in 2023 to approximately USD 2.6 billion by 2033, reflecting a compound annual growth rate (CAGR) of 5.1% over this period. Swine farming has swiftly become a vital component of modern agriculture, offering sustainable and profitable income opportunities, especially for farmers with limited financial resources. Maintaining the health of swine is essential, as various health issues can threaten their well-being. Vaccination is crucial in protecting swine health and ensuring the production of healthy piglets, playing a key role in the industry’s success. Vaccination triggers the immune system to neutralize harmful toxins or generate antibodies that combat infections using specialized cells. By administering antigens derived from bacteria, viruses, bacterial toxins, or parasites directly into pigs, vaccines stimulate an immune response. This response bolsters both humoral (antibody-mediated) and cell-mediated immunity, effectively shielding swine from future infections caused by related pathogens.

Market Size for Global Swine Vaccines Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Maven Market Research

Factors affecting the growth of the Global Swine Vaccines Market

Escalating Swine Disease Outbreaks– The global swine vaccines market is propelled by a rise in global occurrences of swine diseases. African Swine Fever (ASF), for instance, has witnessed an unprecedented outbreak frequency over the past five years. This surge in occurrences has been noted with a threefold increase across various regions. Swine Influenza prevalence has surged by 40% over the past decade, resulting in significant economic losses for the pork industry worldwide. These losses amount to over $5 billion annually due to reduced productivity, higher mortality rates, and trade restrictions. Effective vaccines are crucial in mitigating these impacts while also enhancing animal health and ensuring stability in the food chain, thereby boosting demand for advanced immunization solutions.

Restraints for the Global Swine Vaccines Market

Regulatory Challenges and Vaccine Safety Issues– An important hurdle in the market is the rigorous regulatory environment. The approval processes for new swine vaccines can take up to 7 years (FDA, 2021), highlighting their intricacy (FDA, 2021). Persistent concerns surround safety and efficacy, with 15% of vaccine applications reporting adverse reactions – emphasizing the critical need to strike a balance between vaccine effectiveness and safety to uphold public confidence and market steadiness.

What is the current structure of the Global Swine Vaccines Market?

Based on Product, the Inactivated Vaccines segment dominates the Global Swine Vaccines Market

Inactivated vaccines emerged as the leading segment, capturing the largest revenue share of 30.0% in 2023. This dominance is attributed to their wide availability, cost-effectiveness, and stability advantages over live-attenuated vaccines. Inactivated vaccines prevent pathogen replication, minimizing the risk of virulence reversion post-vaccination. Moreover, they provide swine with robust immunization through rapid cell-mediated immune responses. The addition of adjuvants, such as certain oils or aluminum hydroxide, further enhances immunity. However, meticulous handling during preparation and storage is crucial for optimal vaccine efficacy.

Based on Distribution Channel Types, the Veterinary Hospitals & Clinics Segment will have the largest revenue in the Global Swine Vaccines Market

Veterinary hospitals and clinics dominate the Swine Vaccines Market, holding about 45% of the market share. These facilities are essential in distributing and administering vaccines to pigs. Their dominance is due to their direct interaction with end-users, providing immediate vaccination services and comprehensive healthcare solutions. This close engagement ensures timely vaccine delivery and allows for continuous monitoring of swine health after vaccination, which is crucial for effective disease management in the livestock industry.

Based on Disease Type, the Porcine Reproductive and Respiratory Syndrome (PRRS)disease type will lead the market share in the Global Swine Vaccines Market

The PRRS (Porcine Reproductive and Respiratory Syndrome) segment held the largest revenue share of 10.0% in 2023, primarily due to its extensive prevalence in major swine-raising countries. This disease is endemic and epidemic in nature in regions such as the U.S. and several Asian countries, persisting as an epidemic for over 30 years in the U.S. and more than 20 years in China, a key player in the global swine industry. The significant heterogeneity in the viral genome, stemming from inherent errors in RNA transcription, poses challenges in controlling and managing various isolates, even within the same country.

Based on Regional Analysis, the Asia Pacific region dominates the Global Swine Vaccines Market

Asia Pacific emerged as the dominant region in the swine vaccines market, capturing over 45% of the revenue share in 2023 and expected to achieve the fastest compound annual growth rate (CAGR) during the forecast period. This leadership position is bolstered by the presence of major swine production countries like China, alongside a large consumer base for meat products and a critical need for vaccines to combat increasing disease outbreaks among swine herds in Asia. As of 2021, Asia boasted the highest pig population globally, totaling 462.6 million pigs, with China alone accounting for approximately 347 million pigs. Moreover, China’s substantial pork consumption, recorded at 43,843 thousand tonnes in 2021, further underscores the region’s pivotal role in the swine vaccines market.Countries like the U.S. and Canada benefit from robust healthcare systems and a concentration of key market players, contributing to the region’s growth trajectory in the swine vaccines market.

Competitive Landscape

The market is characterized by intense competition and a number of both major and small firms. To achieve greater market penetration, these companies are continuously engaged in strategic activities including joint ventures, mergers and acquisitions, geographical expansions, new product launches, and so on. For example, Algenex SL and Virbac announced in February 2021 that they had signed an international licencing agreement for the creation and sale of a vaccine based on CrisBio in a significant swine indication. Some of the major player includes are Merck & Co., Inc; Ceva; Zoetis; BoehringerIngelheim GmbH; Elanco; Indian Immunologicals Ltd.; BiogénesisBagó; Phibro Animal Health; KM Biologics; HIPRA; Virbac

Market Segmentation

By Product

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines.

By Distribution Channel

- Veterinary hospitals and clinics

- Veterinary research Institutes

- Laboratories

- Others

By Type

- Swine Influenza

- Classical Swine Fever

- Porcine Parvovirus

- Porcine Circovirus Type 2

- Hyo

- Actinobacillus Pleuropneumonia

- Porcine Reproductive and Respiratory Syndrome (PRRS)

- Foot & Mouth Disease

- Pseudorabies

- Others

By Regional Analysis

Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

North America

- United States

- Canada

Europe

- United Kingdom

- France

- Germany

- Italy

- Spain

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- South Africa

Major players in Global Swine Vaccines Market

- Merck & Co., Inc.

- Ceva 4

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Indian Immunologicals Ltd.

- Biogénesis Bagó

- Phibro Animal Health

- KM Biologics

- HIPRA

- Virbac

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com