Global Light Commercial Vehicle Market: By Propulsion Type, By Classand byGeography (Europe, Asia-Pacific, North America, Middle East & Africa, &South America)—Global Forecast till 2032

- Description

- Additional information

Description

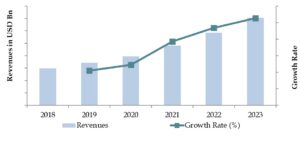

Market Overview: The Light Commercial Vehicle Market was valued at USD 6.1 trillion in 2023 and is estimated to observe a compound annual growth rate (CAGR) surpassing 8% from 2024 to 2032. Driven by rising environmental concerns and government incentives, producers are making substantial investments in the development of electric light trucks. This trend indicates a move towards sustainable transportation solutions and assists global initiatives to lower carbon emissions. The rapid acceptance of electric vehicles (EVs) is projected to accelerate the market growth.

Market Size for Global Light Commercial Vehicle Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Maven Market Research

What Factors are Leading to the Growth of the Global Light Commercial Vehicle Market:

- The growth of the global light commercial vehicle (LCV) market is surged by different factors, including the development of the automotive industry, a rise in industrial activities, and the expansion of the e-commerce industry.

- The global market is projected to see a positive impact throughout the forecast period owing to increased government initiatives encouraging e-mobility and an increasing demand for electric trucks from the logistics sector.

- The growing need for last-mile deliveries and the increasing preference for rental and shared mobility services propels the growth of the global light commercial vehicle market.

Which Industry Trends have been Fueling the Growth?

Expansion in E-Commerce Industry: E-commerce contains the purchasing and selling of goods over the Internet. Thereby, freight transporters handle the shipping of goods from retailers to consumers. Additionally, the e-commerce industry depends on third-party logistics services to achieve and oversee their supply chains, allowing companies to focus on marketing and other business functions. These third-party logistics providers, including FedEx, XPO Logistics, and DHL, use different light commercial vehicles (LCVs) to carry products to the nearest delivery stations. These giant companies maintain larger fleets of LCVs as smaller LCVs are more fuel-efficient compared to heavy commercial vehicles for city commuting. Moreover, the different benefits offered by several vehicle manufacturers to freight transporters are propelling the increased acceptance of efficient LCVs in the e-commerce industry. This trend considerably contributes to the growth of the global light commercial vehicle market.

Strict Government Regulations and Sustainability Initiatives: Governments globally are strengthening stringent emissions regulations to battle air pollution and decrease greenhouse gas emissions. Thereby, manufacturers are being compelled to enhance cleaner and more fuel-efficient vehicles, comprising light commercial vehicles (LCVs). This propel towards sustainability is surging the adoption of electric and substitute fuel-powered LCVs. Businesses are increasingly implementing corporate social responsibility (CSR) initiatives by selecting eco-friendly transportation solutions to bring into line with their sustainability goals. As a result, the light commercial vehicle market is moving towards greener technologies, propelling innovation, and investment in electric and hybrid LCVs.

What is the Current Structure for Global Light Commercial Vehicle Market?

By Propulsion Type, Internal Combustion Engine Segment Registered the Largest Market Growth

By propulsion type, the internal combustion engine (ICE) segment is anticipated to contribute the highest market share in 2024, owing to their widespread usage and established infrastructure for refueling. ICE vehicles have registered the light commercial vehicle insights for decades owingto their benefits in fuel efficiency and cargo capacities, which address the daily operational demands of small businesses and logistics companies.The development and extensive availability of gas stations across the world have made ICE fuels eagerly accessible, even in remote locations, alleviating a varietyof anxiety concerns for commercial vehicle owners. In addition, the affordability of ICE repairs and the widespread aftermarket for spare parts have offered these vehicles high dependability.

By Vehicle Class, Class 2 (6,001 – 10,000 lbs) Segment Dominated the Largest Market Growth

By vehicle class, Class 2 delivery trucks in the 6,001-10,000 lbs category are projected to contribute the highest share in 2024. These mid-duty trucks propose optimal payload capacities that balance cargo capacity with the maneuverabilityrequired for last-mile services. Their dimensions enable efficient multi-stop ways within urban surroundings. Compared to heftier Class 3 or Class 4 trucks, Class 2 trucks have lower buying prices, which enhances the earnings potential per vehicle. Their flexible cargo areas can lodge different delivery configurations, from consolidated parcels to refrigerated loads. The exponential growth of e-commerce has suggestively increased the requirement for last-mile and same-day delivery services, fostering Class 2 truck sales.

By Region, Asia Pacific Dominates the Largest Market Size in the Global Market

The Asia Pacific region dominated the global light commercial trucks market in 2023, holding a significant share. In this region, there is a key trend toward the modernization of light commercial vehicle fleets. Governments are framing regulations to encourage cleaner and fuel-efficient transportation solutions, which is propelling the adoption of electric and hybrid vehicles. Furthermore, the rapid growth of e-commerce is increasing the requirement for delivery vans and trucks, encouraging logistics companies to invest in newer, more technologically advanced vehicles to address the evolving requirements of their customers.

Competitive Analysis

The light commercial vehicles market is characterized by the existence of different regional and local vendors. This global market is extremely competitive, with all players striving to attain a larger market share. Vendors compete reliant on cost, product superiority, reliability, and aftermarket services. As a result, they must offer cost-effective and efficient products to endure and flourish in this competitive environment. Major players are probably to reinforce their regional presence through mergers and acquisitions of both local and international companies, focusing to expand their presence and solutions in different countries in the forecast period. To stay competitive, vendors must develop new technologies that bring into line with emerging trends, confirming their product lines remain competitive in the market.Some of the major players operating in the market includes Ashok Leyland; Bosch Rexroth AG; Daimler; Volkswagen AG; Toyota Motor Corporation; Mahindra and Mahindra; TATA Motors; AB Volvo; Golden Dragon; General Motors

Market Segmentation

Global Light Commercial Vehicle, by Propulsion Type

- Electric & Hybrid

- Internal Combustion Engine

Global Light Commercial Vehicle, by Class

- Class 1 (<6,000 Ibs)

- Class 2 (6,000 – 10,000 lbs)

Global Light Commercial Vehicle Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- Russia

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Rest of Asia-Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- Turkey

- South Africa

- Rest of Middle East & Africa

Market Players Included

- Ashok Leyland

- BAIC Group

- BYD Motors Inc

- Daimler AG

- Dongfeng Motor Corporation

- Ford Motor Company

- Gaz Group

- General Motors Company

- Honda Motor Company

- Hyundai Motor Company

- Isuzu Motors Ltd

- Mahindra & Mahindra

- Nissan Motor Company Ltd

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com