Global Pet Market: By Product Type (Pet Food Products, Veterinary, and Others), Pet Type (Dog, Cat, and Others), By Distribution Channel (Online and Offline), By Region(North America, Europe, Asia-Pacific, Middle East and Africa, and South America) – Forecast period till 2033

- Description

- Additional information

- TOC

Description

Market Overview

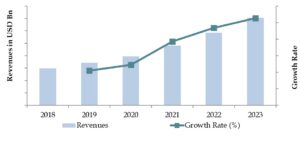

The Global Pet Market is projected to grow significantly, from an estimated US$ 18 billion in 2023 to potentially US$ 39 billion by 2033, with a forecasted compound annual growth rate (CAGR) of 8%. A major catalyst behind this growth is the increasing humanization of pets. As pets become more integrated into our families and daily lives, pet owners are increasingly treating them as cherished members of the household.This shift in perspective has led to a surge in demand for high-end and specialized products and services that cater to pets’ well-being and comfort. From premium pet food and designer accessories to luxury pet spas and pet-friendly travel accommodations, the pet market is witnessing an expansion of offerings that align with the humanization trend.There is also a growing awareness of pet mental health and emotional well-being, driving demand for products and services that address these aspects. Pet owners are increasingly investing in toys, puzzles, and interactive gadgets that stimulate their pets’ minds and alleviate boredom. Additionally, there is a rising availability of pet-specific therapies and calming products to manage anxiety and stress-related issues in pets.

Market Size for Global Pet Market on the Basis of Revenues in USD Bn, 2018-2023

Source: Maven Market Research

Factors Affecting the Growth of the Global Pet Market

- Increased Spending on Pet – Rising expenditure on pet products such as food, health, insurance, grooming, and other essentials is boosting market growth. This trend reflects higher consumption rates of these products, driven by growing infrastructural facilities and increased pet ownership. Additionally, pet ownership is increasingly seen as a status symbol in affluent societies, further fueling demand.

- Diversification of Product Lines– Companies are expanding their product offerings and introducing innovative solutions for pet, including nutrition, grooming, health, and wellness. This diversification aims to cater to the diverse needs of pet owners, enhancing product demand and market expansion.

- Technological Advancements– Initiatives focusing on technologically-enabled pet products are driving innovation within the industry. Products such as location trackers, smart feeders, and interactive toys are gaining popularity, contributing to market growth by meeting the evolving demands of tech-savvy pet owners.

- Market Size and Spending Trends– According to the Pet Advocacy Network’s January 2023 data, pet owners in the U.S. spent approximately USD 50 billion on pet treats and foods out of a total spending of USD 93.95 billion on pets. This significant spending underscores the robust growth potential of the pet market.

Restraints in the Global Pet Market

- Cost Barriers– The higher cost associated with premium pet products can restrict their adoption among lower-income demographics. This disparity in affordability may limit market penetration and consumer accessibility to high-quality pet solutions.

- Health Concerns– Instances of animal-borne diseases, such as gastrointestinal issues and other health risks associated with unhygienic pet living conditions, can deter potential pet owners and impact market growth. Concerns over pet health and safety remain critical factors influencing consumer decisions in pets.

What is the current structure of the Global Pet Market?

Based on Product Type, thePet Food products Segment dominated the largest CAGR in the Global Market

The pet market is segmented into key categories, with pet food dominating due to the high demand for nutritious daily feeding options, supported by accessibility and variety in product offerings. Concurrently, the veterinary segment is experiencing rapid growth, driven by expanding commercial veterinary practices globally. Increased investments in pet health infrastructure, as highlighted by the U.S. Department of Veterans Affairs, reflect growing awareness among pet owners about health and hygiene, further bolstering this segment’s development.

Based on Pet Type, the Dog Segment held the largest market revenue in the Global Market

The pet market’s segmentation by pet type reveals distinct growth drivers across categories. Dogs lead with the largest market share, buoyed by their health benefits and role in home security, fostering higher humanization rates among households. Concurrently, the cat segment is expanding significantly, fueled by increasing online sales of cat products via platforms like Amazon and Walmart, alongside rising ownership rates reported by the American Pet Products Association. Other segments, encompassing reptiles, fishes, birds, horses, and small animals, benefit from growing global awareness and specialized product availability, supported further by the adoption of aquaculture practices among fishermen. These trends collectively underscore a diverse and expanding market landscape driven by evolving consumer preferences and broader trends in pet ownership.

Based on the Distribution Channels, the Offline Segment dominated the largest CAGR in the Global Market

The offline segment, comprising pet stores and supermarkets, is poised to dominate the global market primarily due to the extensive availability of diverse pet supplies through these channels. These outlets provide convenient access to a wide range of pet products, enhancing consumer convenience and driving significant market share. Furthermore, investments in infrastructure related to pet stores bolster the consumption rate of pet products from these outlets, further stimulating segmental growth. This emphasis on offline distribution channels underscores their pivotal role in shaping market dynamics and meeting the diverse needs of pet owners worldwide.

Based on the Region, the North American Region Registered the Largest Market Share in the Global Market

North America leads the global pet market share during the forecast period, driven by substantial spending from Canadian and U.S. consumers on pet-related products and services, resulting in significant revenue generation. The region’s growth is further propelled by high demand among pet owners for premium-quality products. In contrast, the Asia Pacific region shows the fastest growth, supported by the presence of major companies like Mars Incorporated and Nestle S.A. expanding manufacturing facilities in countries such as India and China. This strategic expansion enhances product availability across the region, complemented by a rising middle-class population, which boosts market expansion. Europe is also expected to see considerable growth due to its robust infrastructure of pet stores and veterinary services, facilitating the distribution of animal accessories and food products.

Competitive Landscape

The market is characterized by the presence of a few established players and new entrants. Companies have been expanding their product portfolios by incorporating new and innovative pet care products to widen their consumer base. Some of the major players operating in the market includes Ancol Pet Products Limited; Blue Buffalo Co., Ltd.; Champion Petfoods LP; Hill`s Pet Nutrition, Inc.; Mars, Incorporated; Nestle Purina PetCare; Petmate Holdings Co; Saturn Petcare GmbH; Tail Blazers; The Hartz Mountain Corporation

Market Segmentation

By Product Type

- Pet Food Products

- Veterinary

- Others

By Pet Type

- Dog

- Cat

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- Italy

- Spain

- K.

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- South Africa

- UAE

Major Key Players Leading in the Global Pet Market:

- PetSmart

- Petco

- Petland

- Petmate

- Petfinder

- Adoptapet

- The Shelter Pet Project

- Best Friends Animal Society

- Petco Foundation

- Petango

Additional information

| Report Format | Excel, Excel + PDF/PPT |

|---|

Sample TOC

Call Or E-mail

APAC: +91 77 74 030 494

US: +91 77 74 030 494

UK: +91 77 74 030 494

info@mavenmarketreserach.com